Biden Reaches Out to Xi With Eye on Financial Stability

The US Treasury Secretary Janet Yellen arrived in Guangzhou on the first leg of a six-day visit to China, April 4, 2024

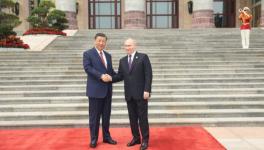

The salience of the phone call from US President Joe Biden to Chinese President Xi Jinping on Tuesday is their consensus that during the period since their summit meeting in Woodside, California, in November 2023, the US-China relationship “is beginning to stabilise”.

Both sides agreed that their discussion was “candid and constructive.” Chinese analysts estimate that there is a common will in Beijing and Washington “to prevent negative factors from influencing the general stability of bilateral ties.”

Xi proposed three “overarching principles” to navigate 2024 — “peace must be valued”; “stability must be prioritised”; and, commitments should be followed up with action.

In general, the phone call can be viewed in positive terms. Both Xi and Biden expressed the wish for stabilising bilateral relations, managing differences, expanding cooperation, and concurred that a stable and predictable China-US relationship is in their interests.

Washington announced after the phone call that Treasury Secretary Janet Yellen will be travelling to China on an extended visit through April 3-9. The US Treasury Department stated that she “will build on the intensive diplomacy she has engaged in to responsibly manage the bilateral economic relationship and advance American interests.”

Earlier, during a press call at the White House, a senior administration official stressed that the Biden Administration has not changed its approach to China, “which remains one focused on the framework of invest, align, and compete. Intense competition requires intense diplomacy to manage tensions, address misperceptions, and prevent unintended conflict. And this call is one way to do that.”

That said, she also listed areas of cooperation in important areas “where our interests align” — counternarcotics, AI, military-to-military communication channels and climate issues. She anticipated that “depending what happens in the coming year, there would be — we would hope there would be a chance for another in-person (summit) meeting, but don’t have anything even to speculate on when that might be. But certainly, value in that in-person meeting and the calls in the interim.”

Yellen’s six-day visit will be followed by a trip to Beijing by Secretary of State Antony Blinken “in the coming weeks.” A call between the defence ministers is also expected “soon.” Indeed, a steady build-up is under way.

Biden initiated the call. Conceivably, Washington, faced with multiple problems at home and abroad, needs China more than the other way around. Bogged down in the conflicts in Gaza and Ukraine, it can ill afford a confrontation in the Taiwan Straits. Again, the US needs China’s cooperation in important areas such as fentanyl control, climate change, Artificial Intelligence, green-energy transition, etc. — and, most important, financial stability.

Financial stability is a core issue. Yellen’s itinerary is anchored on her extended meetings with Vice Premier He Lifeng spread over two days. He Lifeng was appointed last November as head of office of the Central Financial Commission and has become the helmsman of the core financial and economic staff of the Chinese communist party.

Yellen is due to meet Finance Minister Lan Fo’an, Premier Li Qiang, Beijing Mayor Yin Yong, People’s Bank of China Governor Pan Gongsheng, and leading Chinese economists. Clearly, Yellen’s focus will be on financial stability, a crucial template of the US-China relationship.

The US monetary policy is at an inflection point. Financial risks have risen and there is rising uncertainty in the global market. The anxiety shared by investors is evident in the surge in gold’s appeal as a safe haven asset.

The global financial system is buffeted by multiple factors, such as unsustainable levels of debt, geopolitical confrontation, and a new era of low growth, low global investment and de-globalisation. But a major factor affecting the resilience of the global financial system is the current speculation regarding a US interest rate cut, which would have a ripple effect on the world economy.

Historically, US monetary easing has been the harbinger of global financial crises. As the world’s first and second economies, the US and China will be in the cockpit to navigate any global financial crisis, of which the run on gold as safe haven asset by investors is an early warning signal.

The rise of gold prices reflects as much a panic toward the risks surrounding the global financial system as a lack of confidence in US dollar-denominated assets. The point is, the US’ irresponsible monetary policy has greatly affected the international demand for dollars and dollar-denominated assets.

The enormity of the crisis in the US economy cannot be shoved under the carpet much longer. The US national debt today, estimated at $34 trillion, is almost equal to the combined value of the economies of China, Germany, Japan, India and the UK.

Enter China. China’s steady monetary policy has created policy space and tools in reserve for Beijing to cope with any new challenges lying ahead in the global financial system, while its foreign exchange market has become more resilient.

Thus, while a rate cut by the Fed raises fears of continued capital outflows from the US (as lower interest rates mean a lower return rate on investment in US dollar-denominated assets), there is every likelihood that it would make China the preferred destination for international capital inflows.

Belying Western media hype that China is losing attractiveness to foreign investors, top US firms began flocking to China last month, pledging commitment to the Chinese market, announcing new investment deals and setting up new shop or factory floors.

China can become a safe haven for international capital. Its economy is on an upward trend and given the tools at its disposal to ensure financial stability, China’s foreign exchange market is expected to maintain a relatively stable performance at a time of increasing uncertainty in the global financial market.

Why is this a big deal? The heart of the matter is that as the global price of gold soars, a rate cut cycle begins and financial risks deepen, China gets more options in the management of its assets portfolios and this could affect Beijing’s holding of US Treasury bonds.

Beijing’s huge stimulus program helped the West to recover from the 2008 financial crisis. As the rest of the world teeters on the brink of recession, the last thing Western policymakers want is to ruffle China, the biggest driver of global economic growth. Their expectation is that China would help offset an expected slowdown in other parts of the world.

But geopolitical issues come into play. The Taiwan question and Beijing’s friendly ties with Moscow top the list of contentious issues. Biden raised with Xi concerns over China’s “support for Russia’s defence industrial base and its impact on European and transatlantic security.”

The Chinese foreign ministry spokesman Wang Wenbin promptly pushed back that “Other countries should not smear and attack normal relations between China and Russia, should not undermine the legitimate rights of China and Chinese companies, and should not shift blame to China wantonly and provoke camp confrontation.”

Beijing wouldn’t have forgotten that the Obama administration showed its “gratitude” within a couple of years after the 2008 financial crisis by unveiling the “pivot to Asia” strategy to clip China’s wings and contain its rise — a mindset that still defines Biden administration’s flight path.

Xi was upfront warning Biden that “China is not going to sit on its hands” faced with external encouragement and support for Taiwan’s independence. Nor, he said, is China “going to sit back and watch” if the US remains “adamant on containing China’s hi-tech development and depriving China of its legitimate right to development.”

Biden’s response was that “It is in the interest of the world for China to succeed.”

MK Bhadrakumar is a former diplomat. He was India’s Ambassador to Uzbekistan and Turkey. The views are personal.

Courtesy: Indian Punchline

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.