Questioning the Death of Coal –III: Asian Appetite for Black Diamond

This is the third part of a five-part series that examines the global and Indian commitment to transitioning from fossil fuels to clean energy, on why coal is here to stay in India and how replacing fossil fuels with renewables, which are far from clean, will lead to an equally sinister extractive disaster.

More than the West, Asia holds the key to clean energy transition. The continent comprises 48 countries, covers 17.212 million square miles, with a total population of 4.164 billion people. Its top 18 significant economies account for 52% of the world’s population, represent 88% of the people living in the Asia Pacific region and account for 39% of the global primary energy supply.

China and India dominate this landscape. As the world’s most populous countries, they account for 28% of global primary energy supply.

Matters have been dodgy for renewables in Asia even before COVID-19 struck. Five countries in Asia – China, Japan, the Republic of Korea, India and Indonesia – are among the world’s largest emitters, together accounting for nearly 40% of the global total and this is despite significant attention to the renewables space.

Under two billion people in Asia and the Pacific depend on traditional biomass, coal and kerosene for cooking and heating. Governments in most countries are concerned about reducing indoor air pollution and improving the health of rural residents through “clean cooking programmes”. This is why some have “strong institutional focus on access to clean cooking and fuels, difficulties persist in bringing these technologies – such as liquefied petroleum gas (LPG), biogas, electricity, advanced biomass cook stoves and solar cooking – to consumers in the region”.

While underscoring this, the REN 21: Asia and the Pacific: Renewable Energy Status Report 2019 points out that underinvestment in the sector will likely cause Asia and the Pacific to fall short of the target for universal access to clean cooking by 2030. The point is that even without coronavirus, the noble intentions were under threat. The India story will confirm that.

The China story is just as complex.

China Mismatches

For all its celebrated efficiency and unquestioned commitment to renewables, Beijing has a fundamental problem -- a struggle to coordinate installations of renewables with grid construction. Most of the country’s wind and solar potential is located in Western areas, such as Xinjiang, Inner Mongolia and Gansu province, far from the consuming Eastern regions, with challenges connecting them to the grid and concerns about intermittency.

This explains why “coal will still remain a pillar of power generation in the coming years” says Michal Meidan, director for the China Energy Programme at the Oxford Institute for Energy Studies. In fact, Chinese power producers have asked the government to permit the development of between 300 and 500 new coal power plants by 2030, suggesting that coal power capacity should expand to 1,300 GW by 2030, which is 290 GW (giga watt) higher than the current capacity.

Thus, despite the drop in coal's share of primary energy consumption from 70% in 2011 to 59% in 2018, it will still remain the single largest supply source through to 2050. Of course, efficiency levels with coal use in power and industry will improve dramatically. So also in renewables, courtesy the innovations around renewable energy policy and production incentivised by increasing customer demand, cost-competitiveness and collaboration.

The variable nature of renewable energy generation and its impact on grid stability will, however, be a thorn in the renewable side because Asia’s is an expanding system urgently in need of new capacity. Thus, despite the Chinese and Indian commitment or hypocritical averments for the deployment of variable renewables, both countries must turn to coal to keep the home fires burning.

There is also the critical coal fleet age that accounts for a difference in costs between Asian and US/EU power plants. The average age of a coal plant in Asia is around 12 years. This makes them around 30 years younger than counterparts in the United States or Europe. “More than half of the coal power fleet in Asia was built in the past 19 years”, points out Carlos Fernández Alvarez, Senior Energy Analyst with the International Energy Agency or IEA.

Asian Coal Project Pipeline

The non-China Asia story is just as comforting for coal. Southeast and South Asia sport new plants with coal use forecast to grow by more than 5% per year through 2024. Led by Indonesia and Vietnam, South Asia is looking at coal to fuel its industrialisation aspiration. Pakistan has recently commissioned over 4 GW of new coal power plants, with similar capacity under construction, while Bangladesh plans 29 coal-based power plants in the next two decades. Asia’s significant coal project pipeline (See Castlereagh chart) tells its own story.

The most interesting story comes from Japan though. On the face of things, Japan is now seeking to augment its energy self-sufficiency to 24% by 2030 and “restore nuclear as a key base-load electricity source, raising its share to 20-22%. Renewable energy is planned to be the major power source, comprising 22-24% of the 2030 power supply (up from less than 10% in 2016)”. It does not have a clean energy roadmap in place though, over 2020, it will unbundle 10 major utility companies, potentially boosting the growth of the renewables sector.

This needs to be read with what the world’s third-largest economy proposes on the coal front. Japan has gone in for 36 new coal plants. It is on track to add 22 coal-fired power plants at 17 sites in the next five years. Of these, 15 are under construction; climate crisis be damned. With the 22 plants, Japan would have installed enough new coal power capacity to emit “an additional 74.7 million metric tons of carbon dioxide each year, more than the total emissions of countries like Norway and Sweden”, earning for itself the position of the world’s fifth largest greenhouse gas emitter.

This is despite the improved system reliability, cost-competitiveness and performance of renewable energy technologies, which can be deployed in smaller and decentralised applications. As the optimistic REN 21: Asia and the Pacific: Renewable Energy Status Report 2019 points out, they can change “the shape of renewables investment, driving a shift in private and public investor behaviour away from large, centralised fossil fuel generation infrastructure and towards smaller, distributed solar and wind assets (between 0.5 MW and 30 MW)”.

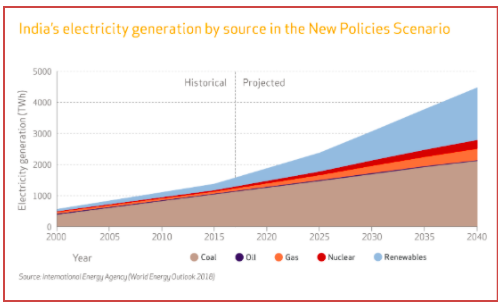

While all this is redefining the role of utilities, the value and role of their transmission and distribution assets, their need to engage with new grid conditions and control systems, it is not providing a comprehensive answer. Advancing economies, such as India, the big player in the Asian space, believe that at the current levels of need, renewables cannot be the sole answer.

India’s fork-tongued averments have been underpinned by Piyush Goyal’s unambiguous announcement in 2015: “We will be expanding our coal-based thermal power. That is our base load power. All renewables are intermittent. Renewables have not provided base load power for anyone in the world”. Goyal was then Minister of State with Independent Charge for Power, Coal, New and Renewable Energy.

On January 10, 2020, India confirmed its commitment to coal, as the January 11, Press Information Bureau release announced the Ordinance promulgated to amend the Mines and Minerals (Development and Regulation) and the Coal Mines (Special Provisions) Act, to pave “way for growth in coal and mining sector”, which has been confirmed by the post-COVID stimulus announcement.

The ordinance had amended the MMDR Act 1957 and the CMSP Act 2015 as approved by the Union cabinet for the purpose of:

- Enhancing the ease of doing business in the coal space.

- ‘Democratising’ coal mining by opening it up to anyone willing to invest.

- Offering unexplored and partially explored coal blocks for mining through prospecting license-cum-mining lease.

- Promoting foreign direct investment by removing the restriction and eligibility criteria for participation.

- Allowing successful bidder/allottee to utilise mined coal in any of the plants of its subsidiary or holding companies.

- Attracting large investment in coal mining sector as restrictions of end use has been dropped.

This is one promise that the government has kept. The May 16, 2020 announcements drive the mining industry to the frontlines of the battle against the economic slowdown. It obliterates distinctions between captive and non-captive mines, allowing transfer of mining leases and sale of surplus unused minerals. Alongside, it rationalises stamp duty payable at the time of awarding of mining leases. It bolsters these measures by a joint (bauxite and coal) open auction of co-dependent raw materials in the mining sector, which will feature 500 mining blocks.

So much for purveyors of the ‘dead’ coal story, especially for India. This will have significant implications for the country’s de-carbonisation goals, given the inconsistent performance in the renewable space.

The Institute for Energy Economics and Financial Analysis got it right. India’s renewable energy progress is “non-linear — two steps forward, one step back”, which jeopardises the renewables economics even for this optimist.

(To be continued)

The writer is a freelance journalist who has been writing on coal since the 1980s. The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.