Prosperous India by 2047? Data Predicts Progress Actually Slowing

Representational Image.

On Friday, in a LinkedIn post about ‘India’s Rising Prosperity,’ Prime Minister Narendra Modi said the country has made “remarkable” progress on equitable and collective prosperity.

Citing a report by the SBI (and one analyis based on it published in the popular press), he said these reports throw light on things that should make people “happy”.

Let us focus on what the SBI report says. Titled ‘Deciphering Emerging Trends in ITR Filing: Ascent of the New Middle Class in Circular Migration’, it notes the changes registered over the last ten years in the threshold of average income of India’s middle class.

The SBI report also looks at where this average middle-class income can be expected to reach in 2047, when India celebrates its 100th Independence Day. It also discusses how the rise in ITR (Income Tax Returns) filed from a particular State does not necessarily portray an accurate picture of changes taking place at the State level.

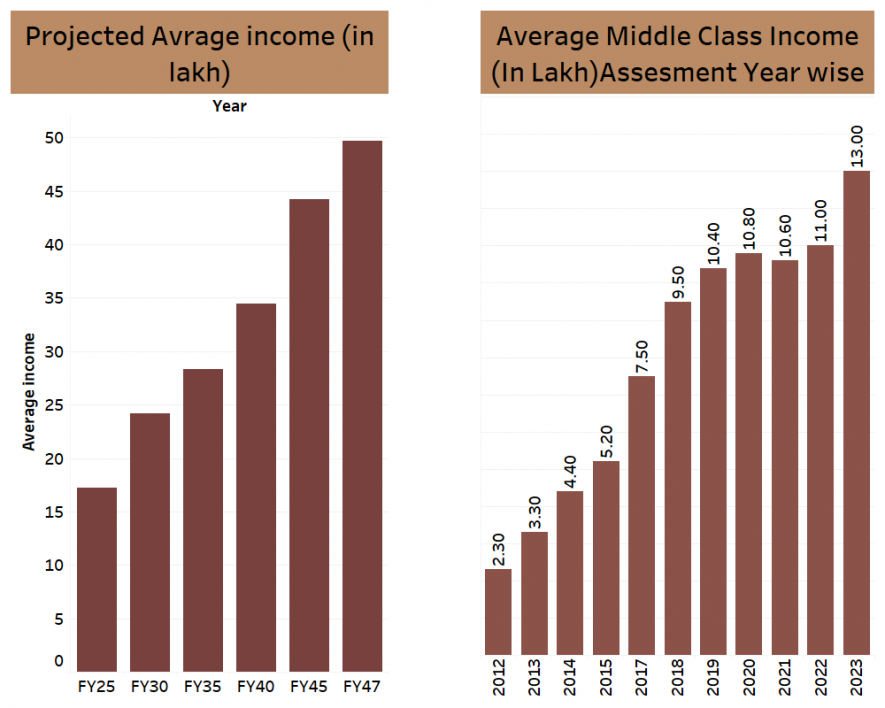

The average income of the Indian middle class tripled from Rs 4.4 lakh per annum in the Financial Year 2013 (which in income tax parlance is the Assessment Year 2014) to Rs 13 lakh per year in Assessment Year 2023.

The report mentions two reasons for this increase. One, the upward migration of people in the lower income group to the upper-income group. And two, it says there has been a significant increase in the number of people who file their tax returns, which has bumped up the average income threshold.

The lower income strata in India is those who earn up to Rs 5 lakh a year. The SBI report notes that between Assessment Year 2012 and Assessment Year 2023, a sizeable share of this strata—13.6% to be exact—left the lowest income strata and migrated to a higher income category.

In Assessment Year 2012, 1.6 crore (or 16 million) people filed their income tax returns, of them, 84% belonged to the lowest income strata of upto Rs 5 lakh annual income.

In Assessment Year 2023, this number went up to 6.85 crore (or 68.5 million) people filing their tax returns. But 64% of them still belonged to the lowest income strata.

The SBI report then projects that by 2047 of the current income tax-filing population in the lowest-income strata, 25% will upgrade to the upper-income categories.

It also projects that the average income will increase from Rs 13 lakh annually at present to roughly Rs 50 lakh in 2047.

It is worth noting that average middle-class income tripled in a decade. However, going by the SBI, even in the next 24 years, the existing average income will not increase even four-fold. This implies the rate at which the average incomes of the middle class is growing is expected to significantly slow down compared to the period between 2013 and 2023.

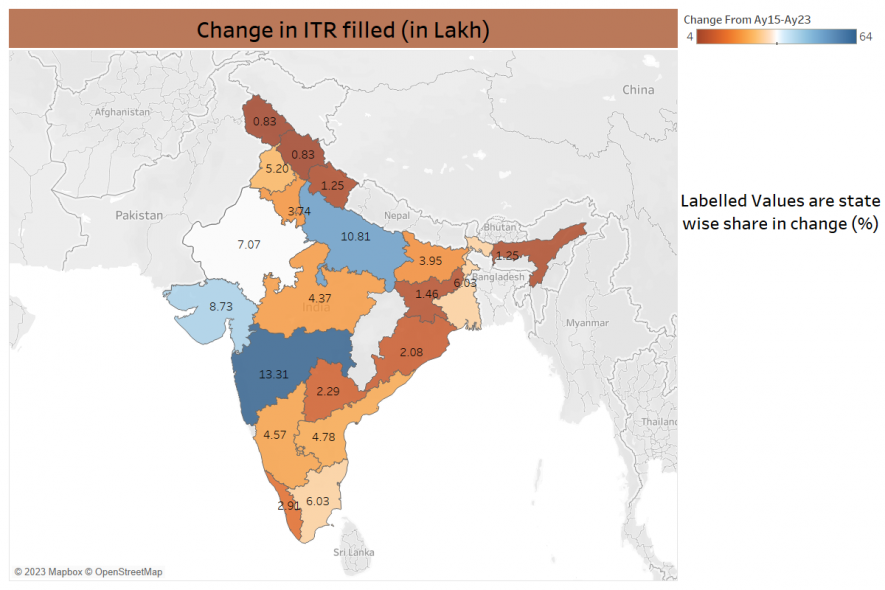

Now let us examine the changes in ITR filing between Assessment Year 2023 and Assessment Year 2015. The SBI report shows that Maharashtra, Uttar Pradesh, Gujarat, Rajasthan, and Tamil Nadu are the top five states. That is, these states constitute 46% of the change in income tax returns filed over this period.

Jammu-Kashmir and Himachal Pradesh have registered the least change in numbers of those filing income tax returns, between Assessment Year 2015 and Assessment Year 2023—with an increase of 4 lakh each.

But the top States, Maharashtra, Uttar Pradesh, Gujarat, Rajasthan, and West Bengal, constitute around 48% of the total income tax returns filed in Assessment Year 2023.

In terms of percentage growth, the smaller states of Manipur, Mizoram, and Nagaland have registered more than 20% increase in ITRs filed during the last one year.

Significantly, the filing of Income Tax Returns should also be seen in terms of the migration patterns from states. This is because ITR filing is linked with a PAN Card. And, for many citizens, the place of work is in a different state than their domicile address mentioned on PAN cards.

Interestingly, in the six net positive migration states, the entire increase in the State GSDP was 7.8% over 2015-2023. And this is almost equal to the decline of 7.7% in the GSDP in the eight net negative migration states. It means that States with net positive migration gained, while those with net negative migration, lost out in terms of economic gains—to a virtually similar extent.

Now consider the top six States where the most Income Tax Returns were filed in Assessment Year 2023. Three of these States—Uttar Pradesh, Rajasthan, and West Bengal—exhibited net negative migration. This brings us to the conclusion that ITRs filed with a domicile address of a particular State does not necessarily present a true picture of the state of affairs.

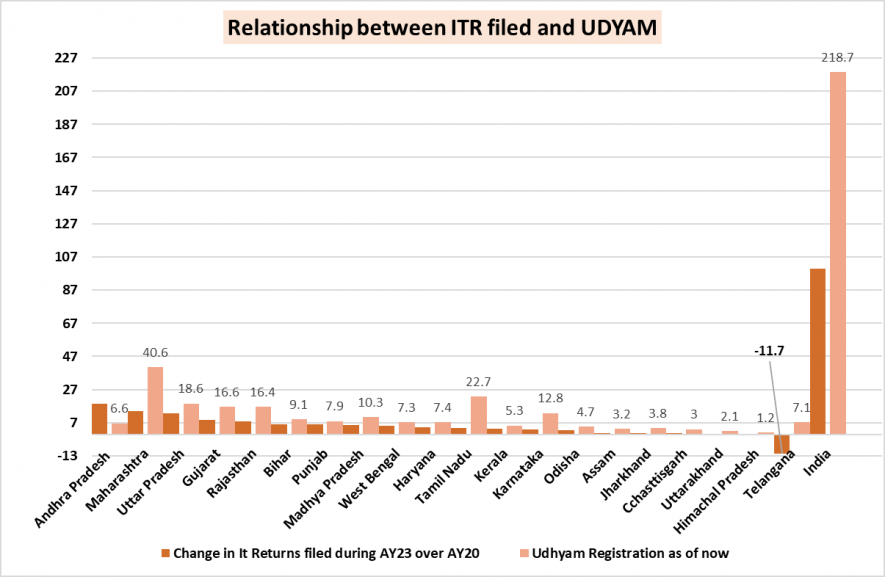

The SBI report credits the large increase in Income Tax Returns filed to the formalisation of the MSMEs (Micro Small and Medium Enterprises) through having them registered on the government’s UDHYAM portal. The portal was launched on 1 July 2020.

The report says, “The top 5 states that accounted for 60% of total incremental increase in ITR filing, also accounted for 45% of total Udyam registration, supporting our contention.”

The report also makes some other projections, like about the per capita income, saying it will register a seven-fold increase from Rs 2 lakh per annum in Financial Year 2023 to Rs 15 lakh in 2047. It says the workforce in India is expected to increase to 725 million (or 72.5 crore) in Financial Year 2047, from 530 million (53 crore) in Financial Year 2023.

In other words, the share in population of the workforce will grow from 37.9% in 2023 to 45% in 2047. This change will translate, according to the SBI report, into an increase in the taxable workforce from 59.1% of the total workforce in 2023 to 78% by 2047.

To be sure, the report does not account for any inflation from 2023 to 2047. The increase in per-capita income will not have the same value as it has today. Assuming an inflation rate of 5%, which is the average of the last 10 years, the increased per-capita income of Rs 14.9 lakh projected by the SBI will have a value of Rs 4 lakh only.

In sum, averages do not necessarily depict the real or full story, as it can also be the case that the income of a marginal section of the middle class population will increase substantially—bringing up the average, but leaving millions still striving in the lowest-income bracket.

The author is a freelance journalist. The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.