Bank Employees To Protest For Pay Hike As Wage Revision Negotiations Fail

Image for Representational Purpose Only

Bank employees in the country are on the warpath after rejecting the paltry 2 per cent salary hike offer made by the Indian Banks’ Association (IBA), the governing body of banking management in India.

Unions of bank employees and officers’ associations will hold protest demonstrations across the country, spread over 8 and 9 May, while a two-day strike will be held towards the end of this month.

Wage revision for bank employees in India has been due from 1 November 2017.

In a meeting held on 5 May 2018 to negotiate the wage revision between the IBA and the United Forum of Bank Unions (UFBU) — which comprises the nine major employees’ unions and officers’ associations — the IBA offered a mere 2 per cent increase over the total wage bill of banks as on 31 March 2017.

During the last (10th) Bipartite Wage Settlement that was made effective from 1 November 2012, the IBA had agreed to a hike of 15 per cent increase over the total wage bill.

“The IBA told us that the banks are not doing well, the profits have come down, therefore they cannot afford to increase the wage bill too much,” said CH Venkatachalam, general secretary of the All India Bank Employees’ Association (AIBEA), speaking to Newsclick.

“But the fact is that the operating profits of banks have been rising, while the net profits have come down only because of the bad loans.”

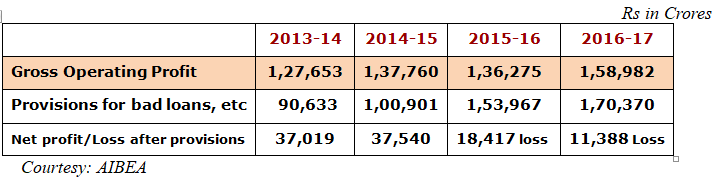

Venkatachalam said that for the past four years, public-sector banks had been making rising operational profits, but it was due to the provisions and concessions for bad loans — around 80% of which are corporate loans — that the banks had been making net losses.

As of 31 March 2017, public banks registered an operating profit of around Rs 1.59 lakh crores, while the provisions for bad loans were more than Rs 1.70 lakh crore, so the net loss was more than Rs 11 thousand crore.

Similarly, in 2015-16, the operating profit was more than Rs 1.36 lakh crore, while the provisions for bad loans were around Rs 1.54 lakh crore. Hence, the banks had net loss of more than Rs 18,000 crore.

“On 6 May, we (AIBEA) wrote to Rajiv Kumar, secretary (financial services), Ministry of Finance, asking him to intervene,” said Venkatachalam.

“The finance ministry had been advising the banks and the IBA to expedite the wage revision settlement and conclude it before 1 November 2017. The discussions between IBA and UFBU began in May 2017, but even after several rounds of discussions the IBA did not come forward to make any offer of wage revision.”

Representatives of UFBU met the Finance Minister in November 2017, and after six months, the IBA resumed the wage revision negotiations in May 2018. But the negotiations failed to move forward as the UFBU refused to accept the initial offer of a 2 per cent hike.

The UFBU consists of the AIBEA, the All India Bank Officers’ Confederation (AIBOC), the National Confederation of Bank Employees (NCBE), the All India Bank Officers Association (AIBOA), the Bank Employees Federation of India (BEFI), the Indian National Bank Employees’ Federation (INBEF), the Indian National Bank Officers Congress (INBOC), the National Organisation of Bank Workers (NOBW) and the National Organisation of Bank Officers (NOBO).

The letter from AIBEA to the secretary (financial services) says, “While we were expecting a reasonable offer from the IBA to make a basis for further negotiations, to our surprise and utter disappointment, IBA made an offer of 2% hike in the Wage Bill as on 31-3-2017. You are aware that in the last settlement from 2012 to 2017, it was agreed at 15% hike in wage bill. Since then the banks’ business have grown, workload on employees and officers have increased beyond tolerable limit, and hence it was expected that wage revision will be better than last time.”

“To substantiate their offer, IBA stated that the financial position of our Banks are not conducive to offer better wage revision and that the Banks profits have been eroded in the recent years. It is well-known that all the Banks have been earning more Operating Profits year after year,” the letter adds.

Venkatachalam told Newsclick, “The government is offering concessions to corporates but punishing its employees. The government should recover the bad loans, but instead Vijay Mallya is sitting in London, Nirav Modi is sitting in America, etc. Even if one bad corporate loan, say Rs 9,000 crores owed by Mallya, is recovered, it will be enough to give a wage hike to the nearly 10 lakh bank employees in the country.”

There are around 8.5 lakh employees in public-sector banks and another 1 lakh employees in private and foreign banks. While the wage revision is decided on the basis of the performance of the public-sector banks, the revision applies to all bank employees, even those of the private sector.

Venkatachalam said protest demonstrations were planned on 8 May in many places, including Delhi, Chennai and Mumbai, while other places will see demonstrations on 9 May.

“A 48-hour strike will be held later this month, the dates for which are yet to be finalised,” he said.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.