Corporate Karza Maafi Soars, But Social Spending – New Lows

This year’s budget write-off in customs duty on gold, diamonds and jewellery (all aam aadmi items, of course) is Rs 75,592 crore. That’s well over twice the “record” amount allocated to the Mahatma Gandhi National Rural Employment Guarantee Scheme. As Prof Jayati Ghosh points out, the MNREGA has given billions of person-days of work to tens of millions of poor rural households this past decade. It has been allocated Rs 34,699 crore. (You can find the gold figure in the Union Budget 2015-16. Just go to the annexure marked Statement of Revenue Foregone; http://indiabudget.nic.in/ub2015-16/statrevfor/annex12.pdf.) This giveaway on gold and precious stones in fact accounts for fully a fourth of all customs duty exemptions. Overall, the budget for agriculture has fallen by more than Rs 5,000 crore compared to last year. The concessions on customs duty on gold, however, have gone up by more than five times that amount in the past 12 months.

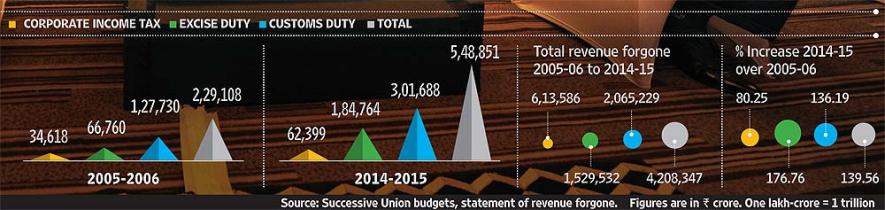

Meanwhile, the feeding frenzy at the corporate trough has crossed the Rs 42 trillion mark this year (or US $678 billion, if you’re among those whose overseas stash the Narendra Modi government has pledged to bring back to our sacred shores). Yup, 42 trillion. As in 12 zeroes. Relief for the corporate needy (and other well-off hungry) recorded in this year’s budget comes to Rs 5,89,285.2 crore. Or Rs 5.49 lakh-crore ($88 billion roughly) if you skip personal income tax which benefits a relatively wider group of people. And the freebies adding up to that total are just those under a mere three heads: corporate income tax, excise duty and customs duty. The Rs 5.49 lakh-crore figure brings the bills for the 10-year orgy to Rs 42.08 trillion. The public pays for the party. The guests enjoy anonymity.

Did I say 10-year orgy? It’s gone on much longer, actually. Just that the government started publishing revenue forgone data only from 2005-06. How much would the total come to if we had the data for earlier years? Oh, well, never mind. This is big enough. Rs 5.49 lakh-crore is the biggest ever instalment in corporate karza maafi in all the years for which the numbers exist. It is also close to 140 per cent higher than the giveaways of 2005-06, the year we started getting this data (see Table 1).

Write-Offs For The Well-Off Touch

Rs 42,000,000,000,000

Revenue Forgone On Gold, Diamonds & Jewellery

2005-06 to 2014-15

This year’s write-offs, though, come in new clothes. Take, for instance, the corporate income tax handouts. Till the 2013-14 budget, the table listing these was called: major tax expenditures on corporate taxpayers. This year the budget has caught up with the semantics of the elite. It’s now called revenue impact of major incentives on corporate taxpayers (emphasis added). Oh, goody. That makes it all fine then. These are incentives, not grabouts. Don’t crib.

Union finance minister Arun Jaitley told a gushing TV anchor last year that he “hoped” there would be no return to wasteful subsidies under the NDA government. He added that it depended on the situation as it unfolded. So here’s how it unfolded. Corporate income tax written off in the statement of revenue foregone of the last UPA budget was Rs 57,793 crore. In the first year of the Modi regime, it was Rs 62,399 crore—about eight per cent higher. It will likely be even higher since this year’s figure is still an “estimated” or provisional one.

But even going by the provisional figure, it means on income tax alone, the corporate world in 2014-15 received write-offs of Rs 171 crore every 24 hours. Or over seven crore every 60 minutes. Add to that the Rs 1.84 lakh-crore in excise duty waived and Rs 3.01 lakh-crore knocked off in customs duty and you have your Rs 5.49 lakh-crore.

A large part of the trillions in NPAs our banks foster was run up by the wealthy who can’t be named due to secrecy laws.

The media reported that Arun Jaitley has given the rural employment programme it’s biggest boost ever. What Jaitley has said is that he would add another Rs 5,000 crore…if there is tax buoyancy. Not so much a promise as a possibility based on other possibilities. Besides, the Rs 34,699 crore allocated for the MNREGA is actually less, not more. The central government already owes the states around Rs 6,000 crore for this year, which they have not paid. So, as Prof Ghosh points out, the new amount for next year will really be less than Rs 30,000 crore. In any case, the MNREGA funding being capped at the level (around Rs 33,000 crore) it has been for three high-inflation years has a different meaning altogether. But it would be wrong to pin this on Jaitley alone. The wrecking of this vital programme for the rural poor was pioneered earlier. Take a bow, P. Chidambaram.

You can run the MNREGA (on present allocation levels) for over 121 years on Rs 42 trillion. But of course we won’t, with a prime minister who makes a point of displaying his utter contempt for the programme on the floor of Parliament.

You can sustain the food subsidy at present levels of funding for 34 years on the Rs 42 trillion. You could undo some of the most savage cuts—to health and child-related subjects for instance. There is, as the HAQ—Centre for Child Rights points out, “a 22 per cent reduction in health-related schemes for children”, and worse, “a 25 per cent reduction in overall education programmes for children….”

But the ‘statement of revenue foregone’ (which should actually be spelt ‘forgone’) reflects a gigantic increase in corporate freebies, in pampering the plutocrats. Customs duties knocked off on gold and precious stones account for more than 10 per cent of all revenue foregone in 2014-15. Take the 10-year period since 2005-06 and the amount lost on customs write-offs on gold, diamonds and jewellery comes to Rs 4.3 trillion. Curb the kids, grow the gold, is it?

There is something quite sickening about this Rs 42 trillion orgy. Something equally nauseous about corporate media quislings who rush to defend the “incentives”. There will be those who insist that these are ‘notional’ or “not handouts”. That “this is for everybody. All benefit”. Fact: the overwhelming share of these incentives/subsidies/write-offs/handouts go to the very well-off. That much, nothing can hide. And remember this: these handouts through budgetary baksheesh for billionaires are only one part of many such processes through which enormous amounts of public money are given away to the rich and famous (but for the banks and media, they are mostly anonymous).

The second point: all these giveaways listed in the tables are only a part of the total handouts beyond the budget, details of which are still invisible to the public. Like, for example, the trillions of rupees in ‘non-performing assets’ (NPAs) with the public sector banks. A very large part of this was run up by wealthy people whose names, it is argued, cannot be divulged under “secrecy laws”. The corporate media are happy to go along with that. Editors have learnt painfully that pursuing it can sometimes cause embarrassment to their owners. There’s an ethical rationalisation too. Banking laws, privacy, confidentiality. Never mind that when it’s the less privileged, banks run advertisements in newspapers (as those in AP did in the past decade), naming petty defaulters and carrying details of public auctions of their gold ornaments to recover a few thousand rupees. No banking ethics and confidentiality for them. The media are okay with that, although they mostly stayed silent when the All India Bank Employees Association (AIBEA) named several hundreds of bigger defaulters late last year. That silence goes on till one of them gets to be such a problem it can’t be swept under the carpet without creating a large and ugly bump in it (that’s when a Vijay Mallya finds himself getting bad press).

Union MoS for finance Jayant Sinha said in a written reply to a question in Parliament that NPAs had gone up (almost trebled) “during the last few years”. The amount, Sinha said, was over Rs 2 trillion. Then there’s an even larger amount tucked away in ‘corporate debt restructuring’. And quite a bit more in what are politely called ‘stalled projects’ (soon to grow up to be NPAs). Estimates of this kind of scamming run to many trillions of rupees (a lot more than the $88 billion budget baksheesh). Then there’s land grabbed from thousands of farmers and transferred at dirt cheap rates to large corporations. And other subsidies. Who says there’s no such thing as a free lunch? Just look at this mob and their lifetime meal tickets. Boy, what a menu they have on the table!

This article first appeared in Outlook as “So Richie Rich, Have Another One On Us“

Disclaimer: The views expressed here are the author's personal views, and do not necessarily represent the views of Newsclick

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.