Debt Haunts India, And Govt is Not Helping

Image Courtesy: Flickr

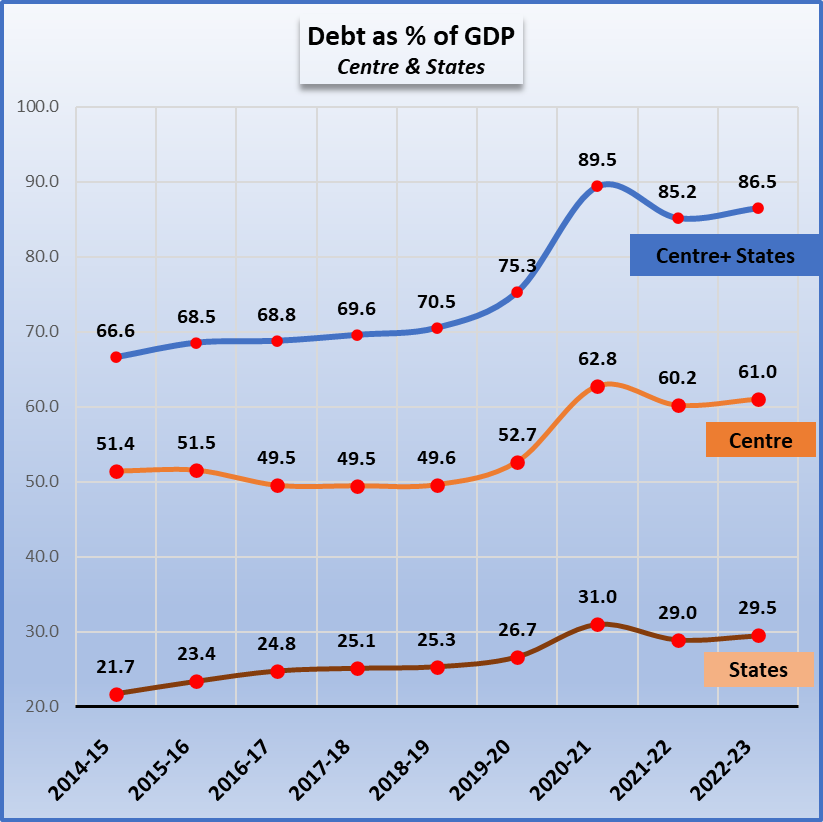

Last December, there was much huffing and puffing after the International Monetary Fund (IMF) raised the issue of India’s growing debt. Government representatives rushed to deny any threat to the economy and assured everybody that the combined debt of the Central and states’ governments reaching 86.5% of GDP (gross domestic product) in 2022-23 was not a crisis.

As the chart below shows, the combined debt has steadily risen from about 67% of GDP in 2014-15 to reach its present level, with a peak of nearly 90% of GDP in 2020-21, when the Covid pandemic hit India. The chart also shows the contributions of the Centre and states separately: in 2022-23, the Centre’s debt made up 61% of GDP while states’ total debt clocked in at 29.5%. All these figures are from the Reserve Bank of India’s database.

Clearly, debts of both sides have risen in the past decade or so. It is often argued that this is not a problem because the 100% of GDP mark has not yet been crossed, and also that most developed economies have higher debt-to-GDP ratios. In short, there is nothing to worry about.

However, combined with low incomes, stagnating employment and high inflation, such high debt levels should be a cause of worry. Even more worrisome is the fact that the Central government appears to be borrowing in order to fund capital investment, which has been tom-tommed as an achievement. Most of this has gone into infrastructure, such as highways and bridges. There was hope that this would encourage private sector investment to follow suit, but that has not materialised.

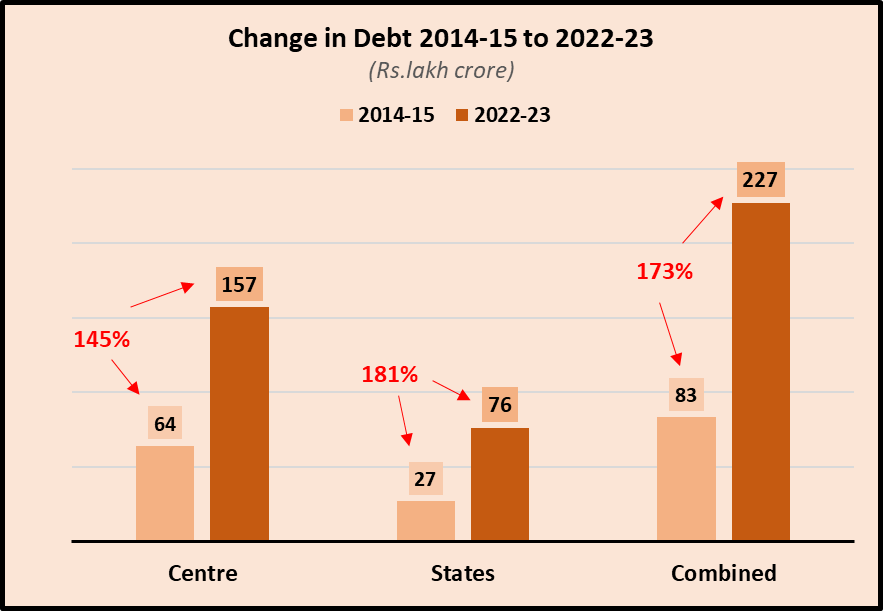

Meanwhile, quite recently, a fresh controversy has arisen about states’ debt levels. The Central government accused some state governments – like Kerala’s – of taking on too much debt. This is despite the fact that state governments’ scope for borrowing is tightly controlled by Central laws. There is no doubt that the debt of all states put together has increased (See chart below) although the absolute level is still half of the Central government debt.

But there is need to look at the reasons for this growth in states’ debt, which are quite distinct from the reasons why Central government borrowings have grown. States have been put under a squeeze in the past decade much more with the Centre pruning or even withholding certain fund releases for long periods. For instance, GST (goods and services tax) compensation to states was delayed year after year. In some cases, release of funds for Centrally-sponsored schemes are regularly delayed and states have to borrow or otherwise arrange funds from their own meagre resources to keep the schemes running.

Most of this squeeze can be traced back to the imposition of GST in 2017 which snatched away much of states’ taxing powers, reducing them to dependence on Central devolution of funds. Some states have alleged that Finance Commission funds, too, are not being fully disbursed. All of this is flowing from the centralising and restrictive tendency of the Central government that is a hallmark of the present Narendra Modi government.

However, the story of debt goes beyond the fiscal – government finances – framework, although mainstream economists will not look at it this way.

Debt Burden on People

There is massive indebtedness among the people of the country which is arising directly out of the economic policies of the Central government. Average debt in rural areas was Rs.60,000 per household, while in urban areas it was Rs.1.2 lakh, according to an NSSO report for 2018. Remember: this is debt averaged out – spread over – the whole population, not just limited to actually indebted households. For comparison, note that back in 2012, the average debt for rural households was Rs. 32,522 and that for urban households, Rs. 84,625, according to a similar NSSO survey in 2012. Low incomes, massive under-employment and unemployment, insecure jobs are some of the reasons why families are forced into debt.

The crisis in agriculture is one of the leading causes of indebtedness in both cultivator and labourer households. High input costs, government’s refusal to ensure Minimum Support Price covering comprehensive cost (C2) and 50% more (as recommended by the M S Swaminathan Commission) and low procurement by government have combined to force farmers into borrowing more and more just to survive. This is especially the case with small and marginal farmers that make up two- thirds of all farmers.

Another cause for the vicious cycle of debt is that institutional debt – borrowing from banks etc. – is limited, especially in rural areas, forcing people to take recourse to moneylenders who charge usurious rates of interest. This often leads to long periods of indebtedness. Non-institutional borrowing is nearly 49% in rural areas and about 36% in urban areas.

Personal Loans Increasing

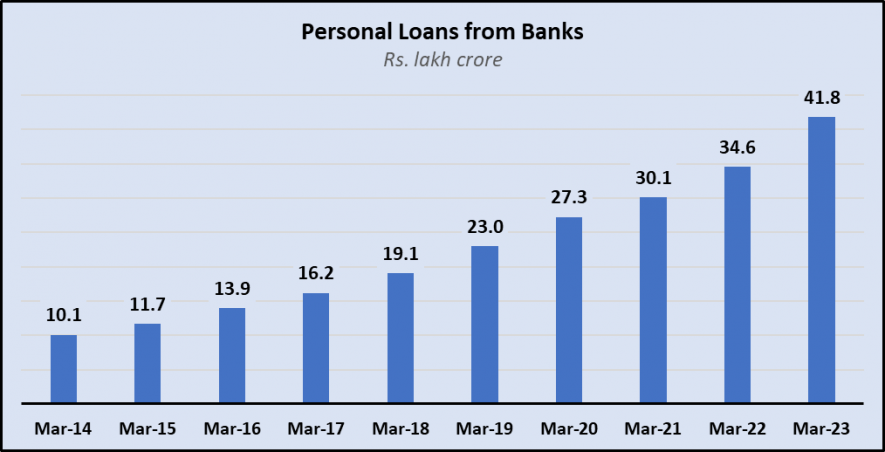

Another trend that has emerged as a consequence of low purchasing power and pushing people to spend more on consumer goods, including durables, is the rising quantum of personal loans. The Sarkari push for cashless transactions and sky-rocketing costs of education have also contributed to this explosion of personal loan outstanding.

As shown in the chart below, personal loans outstanding with scheduled commercial banks increased by a mind-boggling 314% - from Rs.10.1 lakh crore in March 2014 to Rs.41.8 lakh crore in March 2023. This data is from RBI.

Personal loans include borrowing for consumption expenditure, buying durables, automobiles, houses or land, and education loans. It also includes credit card debt which is exploding at a very high rate.

Indian People Bear This Combined Burden

The debt incurred by governments is ultimately paid off, with interest, by public money collected through taxes of various kinds. Much of this tax burden is borne by common people through indirect taxation. Under the present government, massive tax concessions have been given to the super rich corporate sections, including a straight cut in corporate tax itself.

On the other side, through devious means like keeping petroleum prices jacked up artificially, common people have been paying increased tax just to fund the government’s borrowing spree. All this adds over and above the personal or family debt that is incurred just to go through life, pay for education and medical spending, and other reasons.

The government can ameliorate this tragedy by ensuring better wages to workers/employees, giving better remunerative prices to agricultural produce, increasing spending on education and health, boosting public sector and jobs – and by taxing the rich corporates more to curtail super profits and put that money into service of common people.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.