Nearly Rs 5,000 Crore NREGA Wage Payments Rejected in Past 5 Years: Report

Image Courtesy: Reuters

New Delhi: Workers have to face devastating hurdles to access their meagre wages for the work provided under the National Rural Employment Guarantee Act (NREGA), pointed out a report published by LibTech India, a group of social scientists, activists, engineers, and data scientists, has been working on various aspects of NREGA across several states.

Delays in wage payments are one of the most pressing issues faced by workers. Various governments have paid much attention in the last decade on the technological aspects of the digital payments architecture through the paradigm of Direct Benefits Transfer (DBT), through which state governments directly transfer money to the bank accounts of the workers.

However, even after this money reaches the bank or postal accounts of the workers, they have to face a large number of challenges to access this money which is rightfully theirs, said the report.

LibTech surveyed 1,947 workers from Andhra Pradesh, Rajasthan, and Jharkhand.

The workers were asked about their experience concerning four payment disbursement agencies -- Banks, Customer Service Points (CSPs)/Business Correspondents (BCs), Post Offices, and ATMs. Post offices were prevalent only in Andhra Pradesh.

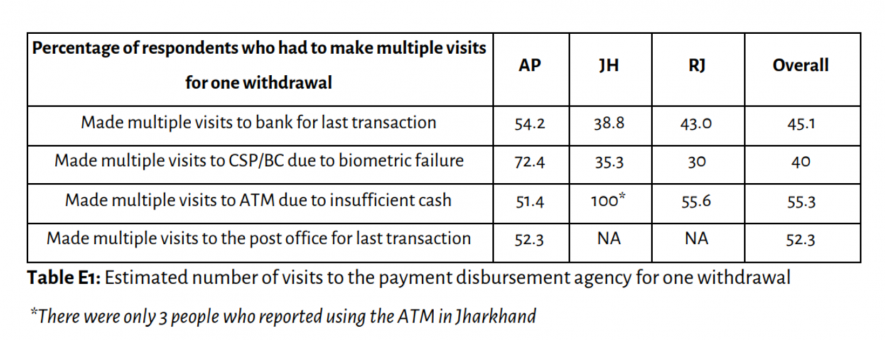

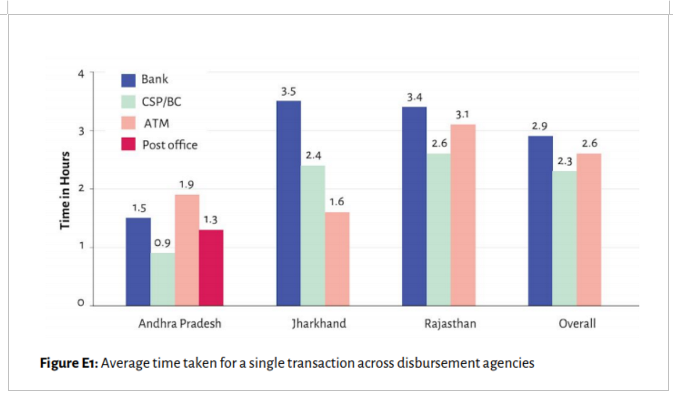

The survey found that 45% of the workers had to visit banks multiple times and an estimated 40% of CSP/BC users had to make multiple trips due to biometric failures. 57% of the respondents reported that their passbooks don't get updated. An estimated 42% in Jharkhand, 38% in Rajasthan took more than four hours to access wages from banks. In comparison, this was just 2% in AP.

According to the report, countrywide, roughly one in 20 wage payment transactions get rejected due to technical errors such as incorrect account number or incorrect linking of Aadhaar with bank accounts.

According to economist Jean Drèze, who wrote the foreword of the report, “When the NREGA wage payment system moved to Aadhaar-based payments such as DBT and APBS (Aadhaar Payments Bridge System), a new generation of payment problems emerged. One of them was the problem of “rejected payment”.”

According to the report, nearly Rs 5,000 crore of NREGA wage payments were rejected during the past five years.

Other Aadhaar-related problems include diverted payments (money being sent to a wrong account) and blocked payments (money being inaccessible to the worker, e. g. for lack of compliance with e-KYC). Drèze said, “Predictably enough, payment problems were especially common in the poorer, less well-governed states, where they had a tremendous discouragement effect on rural workers. In Jharkhand, whenever we enquire about their interest in NREGA work, rural workers often say something like “Bhugtan sahi naheen hota hai to kya fayda?” (without proper payment, what is the point?)”

Even when workers are able to successfully link their job cards and accounts with Aadhaar, they are unable to keep track of the transactions in their account. While all the bank and post office users were issued a physical passbook, about 56% of all those who opened accounts at CSPs/BCs were not issued passbooks. As much as 57% of respondents reported that their passbooks do not always get updated. This was most severe in Rajasthan, where about 69% reported that their passbooks never get updated on withdrawals.

It was also pointed out that awareness about banking norms and rights was low among the workers. According to the report, nearly 75% of all the respondents did not know if they could transact in any bank branch. “Further,” it added, “workers do not have reliable information on wage credit. Around 36% of the workers needed to visit the bank to find out about wage credit and about a quarter of them were misinformed about wage credit and so had to make multiple visits just to find out if their wages had come. Ironically, we also found that higher awareness amongst workers does not reduce their hardships in accessing the wages.”

The report pointed out that the average cost incurred to visit post offices to withdraw wages is the lowest at Rs 6. In comparison, it costs Rs 31 to visit a bank, Rs 11 for a CSP/BC and Rs 67 for an ATM. 57.5% of the post-office users incurred no cost to visit a post office.

Rejected payments are a very common occurrence vehicle payment of NREGA wages. They occur when the DBT cash transfers fail due to technical reasons. Workers do not get these wages unless the rejected payments are rectified. According to official figures, as of July 2020, in the last five years, about Rs 4,800 crore worth of payments were rejected and about Rs.1,274 crore worth is still pending to be paid to workers.

The system lacks a grievance redressal mechanism. The report said, “Hardships have been normalised, meaning that even obvious violations of the Act are not construed as legitimate grievances by workers. In the event when workers did recognise that the issue constituted a grievance, they seldom registered it officially. Overall, about 546 (of 1947) respondents communicated their complaints- of which about 94% did so verbally. The remaining 6% filed them in writing and only 1 respondent among them filed the complaint online.”

It added that there was not much interstate variation in the proportion of respondents who filed grievances. However, it added, more people in Andhra Pradesh did seem to verbalise their complaints. A large majority (79%) of the grievances were about pending wages and partial wages received.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.