How Did BJP Handle 2016-17 Budget?

Image Coutesy: Patrika

Narendra Modi government continued to fail in meeting its fiscal and revenue deficit targets again in 2016-17, noted the Comptroller and Auditor General of India (CAG) in its latest report. The audit found that about 17 per cent of total direct tax amounting to Rs 1.72 lakh crore (including interest on refunds of taxes) in 2016-17 was paid back as tax refunds.

CAG report on the compliance of Fiscal Responsibility and Budget Management (FRBM) Act, 2003, observed that the central government did not adhere with various provisions on FRBM, resulting in inconsistencies and variations with regard to financial transactions.

Among 28 ministries, expenditure of grants for the creation of capital assets was overestimated by Rs 4770 crore when compared to the budget estimates. Similarly, Rs 2078 crore was underestimated resulting in net overestimation by Rs 2692 crore, the audit revealed.

In 2016-17 budget, the government fixed target of revenue deficit, fiscal deficit and effective revenue deficit at 2.3 per cent, 3.5 per cent and 1.2 per cent of GDP respectively. But the actual achievement was 2.1 per cent, 3.5 per cent and 1 per cent of the GDP respectively, as per the audit analysis. These results are in contrast with the FRBM targets of revenue deficit (2.1 per cent), fiscal deficit (3.3 per cent) and effective revenue deficit (0.9 per cent).

On top of this, the government even understated the revenue deficit. “Misclassification of expenditure, non-transfer of levy or cess to earmarked funds in the Public Account from the Consolidated Fund of India, etc. resulted in understatement of revenue expenditure at least by Rs 50,999 crore and hence revenue deficit was understated by the same amount,” revealed CAG.

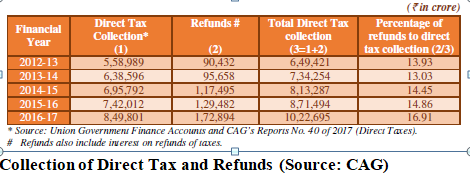

Rise in Direct Tax Refunds

In 2012-13, while tax refunds stood at 13.9 per cent of total direct tax, the figure has gradually increased over years and the tax refunds in 2016-17 was about Rs 1.72 lakh crore (17 per cent of total direct tax collected). Of the total of Rs 8.49 lakh crore collected as total direct tax in 2016-17, Rs 10,312 crore was expenditure on interests on refunds. However, the CAG observed that the government did not disclose the details of the refunds.

“Though the amount of refunds was substantial, no information about the quantum of refunds was disclosed either in the annual financial statement or in the union government finance accounts. As such, the accounts of the government were not transparent in respect of information on tax revenue collections,” concluded the CAG.

Furthermore, the CAG found that a staggering amount of Rs 7.6 lakh crore was understated in public account liabilities during 2016 budget, resulting in a burden of total liabilities of about Rs 76,69, 545 crore on the government in 2016-17. This figure is 50.5 per cent of the GDP, as against the budget estimate of 45.5 per cent of GDP.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.