The Tragi-Comedy of Jobs Numbers

What was started last year as a trial balloon has now become a joke, after getting sanctified by everybody in the govt., from PM Modi downwards. Yesterday, the govt. released new numbers on how many people enrolled in three of its social security schemes, provident fund (EPF), employees health insurance (ESI) and pension (NPS). These numbers show that EPF added over 1 crore new members, ESI added 1.19 crore and NPS some 6.1 lakh.

After last year’s concerted attempt to add up all of these and claim the grand total as new jobs created was roundly criticised and shown to be false, this latest data release says that these are “different perspectives on the levels of employment in the formal sector and does not measure employment at a holistic level”.

The reasons why this caveat became necessary included – the enrolment in schemes is not additive because the same person may be enrolling in all three; just new enrolment doesn’t equate with new jobs because others would be leaving jobs and so net creation of jobs is the more pertinent number; and, the schemes have their own boundaries (like income limit, number of employees for becoming eligible etc.) and can’t possibly reflect all jobs in the formal sector, forget about all jobs generally.

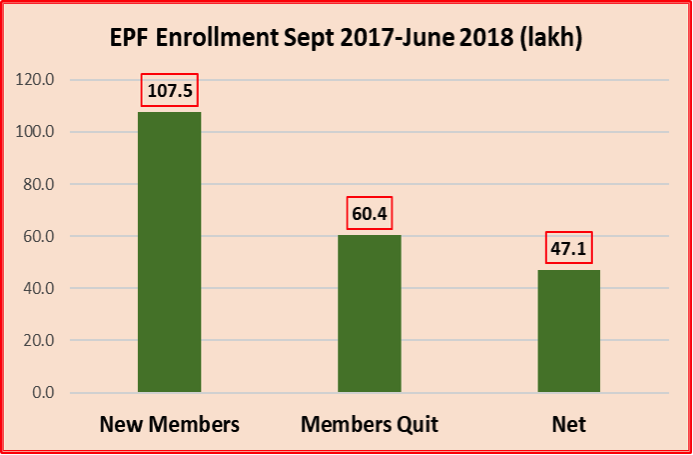

So, the govt. is now putting out new enrolment as well as numbers of those who are quitting the schemes. For instance, while 107.5 lakh new members were enrolled in EPF, 60.4 existing members quit the scheme. So net addition works out to 47.1 lakh.

But even this is not free of questions. These 47.1 lakh people could have been previously employed and entered the scheme now. There is no data to clarify this. Some have argued that the younger ones – say, up to 25 years of age – could be assumed to be first-time employees. This is uncertain, and given the dire jobs situation very unlikely. Youngsters are starting to work even by the age of 16-17, especially boys. It cannot even be said that these new enrollments are measures of formalisation of jobs because who knows whether somebody was working in a formal job or not before becoming the newest member of EPFO?

So, the only thing that can really be said with absolute certainty is that in these ten months, some 60.4 lakh employees went out of the scheme. These will include those who passed away, and those who retired, but also those who lost their jobs or shifted to jobs where there is no EPF coverage (like a casual job or a contract job).

In other words, the numbers show the instability, the flux – indeed the chaos – of industrial employment and its social security coverage.

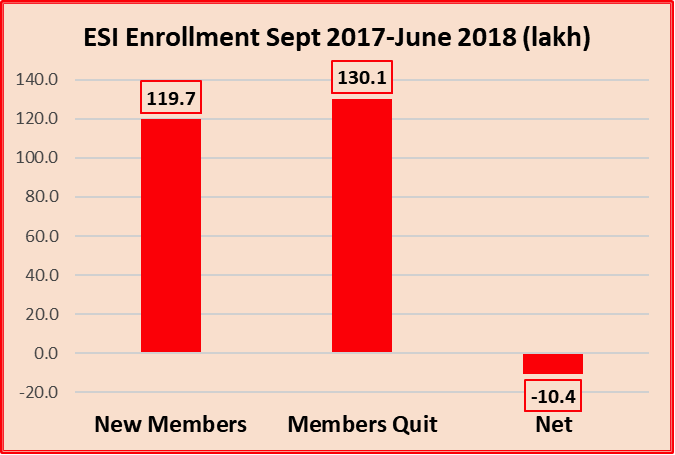

What about the other major scheme, the ESI? The numbers are even more worrying. More people have quit the scheme (130.1 lakh) than have joined up (119.7 lakh) in the past ten months. That means, there is a net decline of 10.4 lakh in this period.

Of course, just like EPF, those quitting ESI would include those passing away, retiring etc. But can these contingencies account for over 1.3 crore persons? More likely, a substantial share is simply getting shunted out of the coverage.

Both these schemes are displaying the sand castle of employment in India – rapid changing of jobs, in and out of social security schemes, and consequent wild swings in coverage numbers. Note that all these are described as ‘provisional’ figures. As Newsclick had pointed out earlier, sarkari estimates themselves change with time.

What all this means is that the so-called ‘Employment Outlook’ put out by the govt. in order to shield itself from the growing outrage at joblessness is not worth the megabytes it occupies on govt. websites. It would be a comic interlude amidst the grim reality of these times, except that it reflects a monumental tragedy – the tragedy of vast numbers that are unemployed. Remember, latest estimates by CMIE peg current unemployment rate at a high of 6.5%.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.